Exhibit 99.2

August 2021

Why Clever Leaves? 1 Low - cost, pharma - quality cannabis production through Colombian and Portuguese operations We believe we have an opportunity to scale efficiently as a result of structural cost advantages. $57 million cash on hand provides an opportunity for durability and ability to execute our plan (1) Global cultivation footprint of 1.9M sq. ft., ~1/2 of Colombia’s national and ~18% of global THC quota (2) EU GMP, INVIMA GMP, GACP certified Colombian cultivation and post - harvest facilities; named Project of National and Strategic Interest by Colombian authorities; GACP certified Portugal cultivation We believe our non - cannabis nutraceutical platform, Herbal Brands, can be leveraged for U.S. market entry and CBD product launch (1) Reflects cash balance on June 30, 2021. (2) Source: International Narcotics Control Board We believe we are well positioned to benefit from U.S. federal regulatory reform and other international market legalization

2020/2021 Key Milestones and Accomplishments 2 Financial Highlights Operational & Regulatory Highlights Target 2021/2022 Key Milestones Execute on fulfilling customer orders and addressing regulatory requirements Begin distribution of branded medical cannabis products in Germany Commercially launch first CBD product in the US Completed the largest SPAC deal in cannabis industry in 2020; ~$80MM in pro forma cash Dec. 2020 CLVR made its debut on the Nasdaq Dec. 2020 Clever Leaves added to NYSE - listed Cannabis ETF, THCX Feb. 2021 Obtained GACP certification in Colombia June 2020 Awarded EU GMP certification in Colombia July 2020 Licensed to cultivate, import / export cannabis in Portugal Aug. 2020 Declared Project of National and Strategic Interest by Colombian Government Sept. 2020 Obtained GACP certification in Portugal Mar 2021 Commercial Highlights Launched B2B business platform (Feb. 2020) Feb. 2020 Initiated commercial relationships with a diverse set of partners 2020/21 Expanded distribution capabilities to 15+ countries across 5 continents Feb. 2021 Portfolio Company, Herbal Brands subsidiary received first CBD shipment imported from Colombia Feb. 2021 Closed out 2020 with revenue growth of 55% y/y; YTD’June 2021 revenue growth of ~47% y/y May 2021 Feb. 2020 Expand and announce new commercial partnerships (1) Subject to obtaining regulatory approvals, levels of customer demand and other factors referenced on slide 26 that could impa ct our ability to achieve key initiatives. Announced agreement to supply finished CBD products for the Brazilian and Peruvian markets. Apr. 2021 Delivered first revenue from Portugal in Q2 2021 First legal shipments of Colombian cannabis to US, with DEA import permits July 2021 Closed $25mm financing from SunStream and simultaneously saved $3mm by redeeming existing Convertible Note Announced entry into Mexico; Sent first commercial flower shipment to Australia Jun 2021 July 2021 Export of Colombian cannabis flower authorized by Presidential decree at Clever Leaves facility Formulate partnerships with leading US universities through Project Change Lives Prepare Colombian flower for sale, given regulatory change New New

3 • The cannabis industry has been defined by Canadian Licensed Producers (LPs) and US Multi - State Operators (MSOs) • Clever Leaves is focusing on being a leading Multi - national Operator (MNO), with several defining characteristics: Defining a Multi - National Operation (MNO) 3 Capital efficient business model B2B Focus on Cultivation and Extraction Not confined to a single geography No 280E taxes; business model creates new financing options; NASDAQ listing Tailwinds from further legalization unlike those losing initial market protections

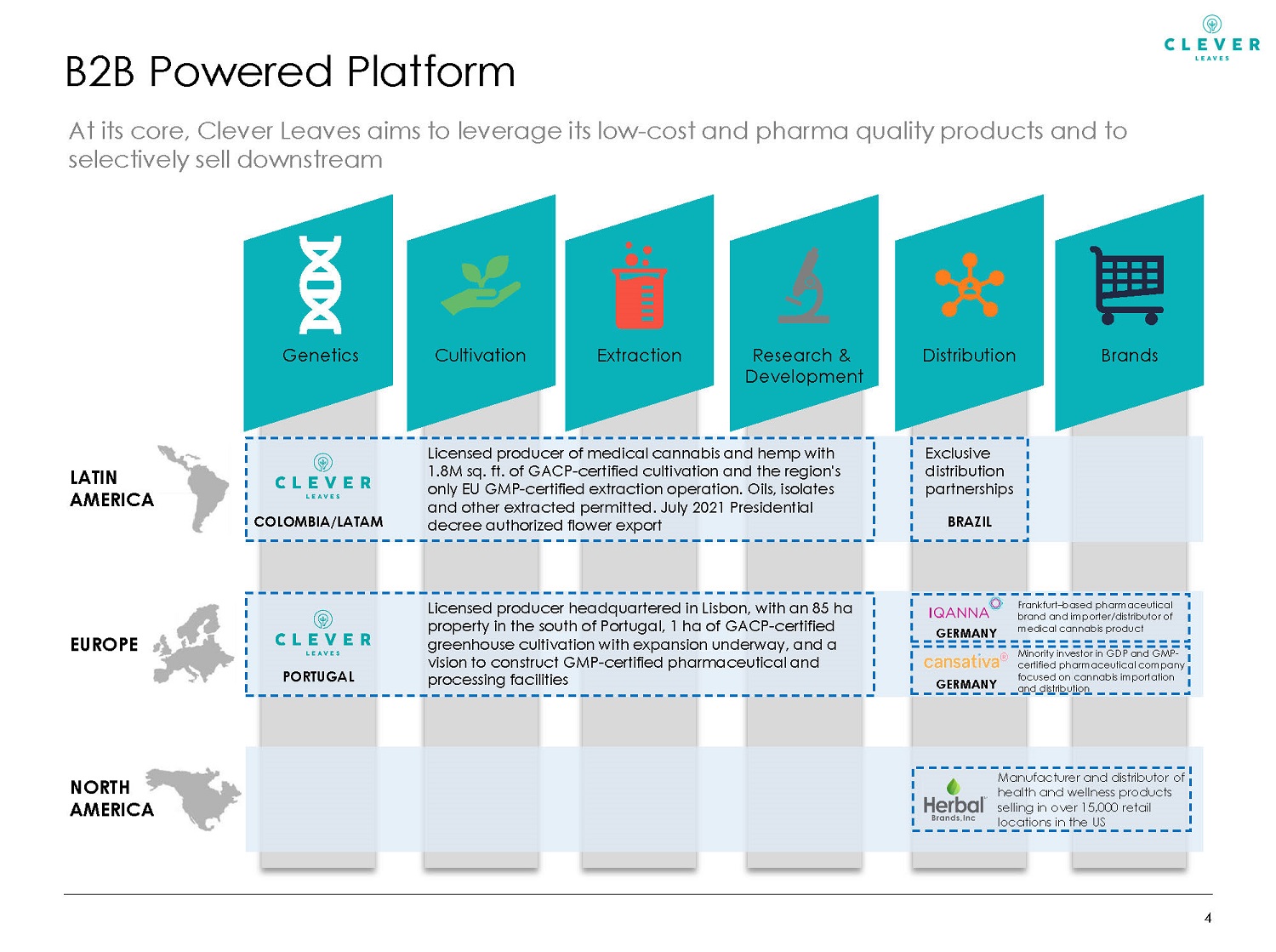

Distribution 4 B2B Powered Platform Genetics Cultivation Extraction Research & Development Brands Manufacturer and distributor of health and wellness products selling in over 15,000 retail locations in the US NORTH AMERICA EUROPE PORTUGAL Licensed producer headquartered in Lisbon, with an 85 ha property in the south of Portugal, 1 ha of GACP - certified greenhouse cultivation with expansion underway, and a vision to construct GMP - certified pharmaceutical and processing facilities Frankfurt – based pharmaceutical brand and importer/distributor of medical cannabis product LATIN AMERICA Licensed producer of medical cannabis and hemp with 1.8M sq. ft. of GACP - certified cultivation and the region's only EU GMP - certified extraction operation. Oils, isolates and other extracted permitted. July 2021 Presidential decree authorized flower export COLOMBIA/LATAM At its core, Clever Leaves aims to leverage its low - cost and pharma quality products and to selectively sell downstream Minority investor in GDP and GMP - certified pharmaceutical company focused on cannabis importation and distribution Exclusive distribution partnerships BRAZIL GERMANY GERMANY

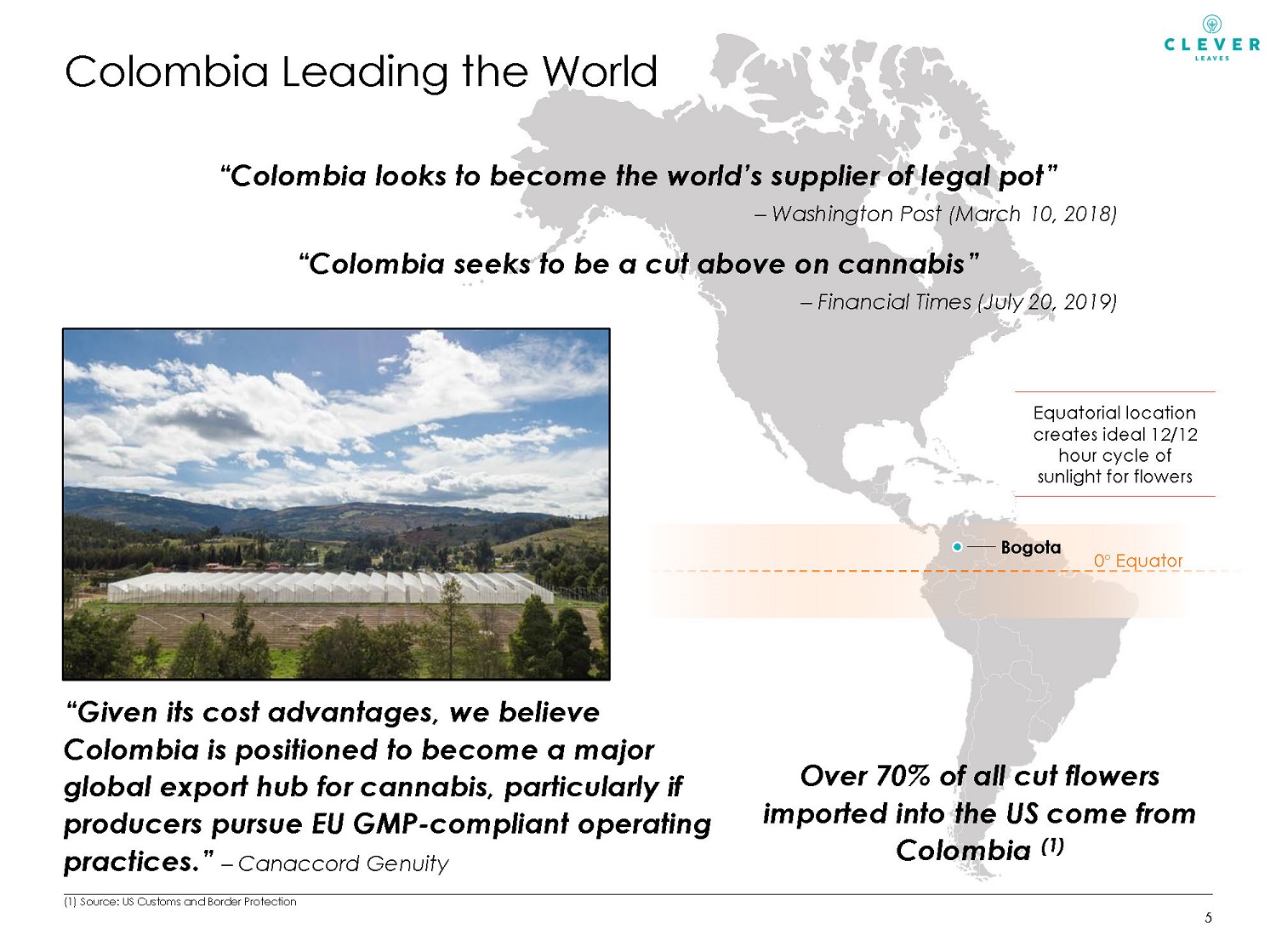

Colombia Leading the World 5 “Colombia looks to become the world’s supplier of legal pot” – Washington Post (March 10, 2018) Over 70% of all cut flowers imported into the US come from Colombia (1) Bogota 0 ƒ Equator Equatorial location creates ideal 12/12 hour cycle of sunlight for flowers “Given its cost advantages, we believe Colombia is positioned to become a major global export hub for cannabis, particularly if producers pursue EU GMP - compliant operating practices.” – Canaccord Genuity “Colombia seeks to be a cut above on cannabis” – Financial Times (July 20, 2019) (1) Source: US Customs and Border Protection

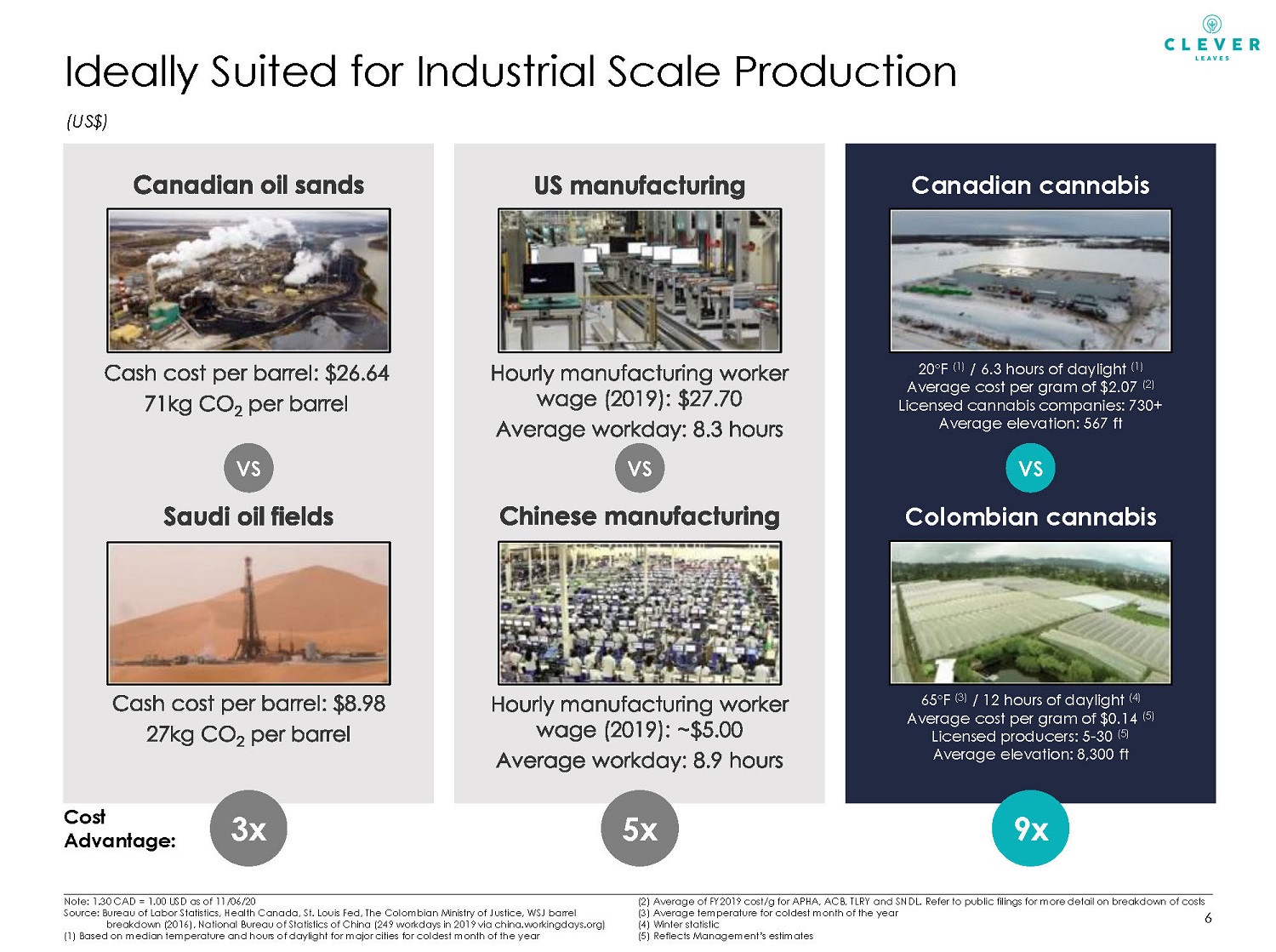

Ideally Suited for Industrial Scale Production 20 ƒ F (1) / 6.3 hours of daylight (1) Average cost per gram of $2.07 (2) Licensed cannabis companies: 730+ Average elevation: 567 ft Canadian cannabis 65 ƒ F (3) / 12 hours of daylight (4) Average cost per gram of $0.14 (5) Licensed producers: 5 - 30 (5) Average elevation: 8,300 ft Colombian cannabis Cost Advantage: VS VS VS 3x 5x 9x Note: 1.30 CAD = 1.00 USD as of 11/06/20 Source: Bureau of Labor Statistics, Health Canada, St. Louis Fed, The Colombian Ministry of Justice, WSJ barrel breakdown (2016), National Bureau of Statistics of China (249 workdays in 2019 via china.workingdays.org) (1) Based on median temperature and hours of daylight for major cities for coldest month of the year (2) Average of FY2019 cost/g for APHA, ACB, TLRY and SNDL. Refer to public filings for more detail on breakdown of costs (3) Average temperature for coldest month of the year (4) Winter statistic (5) Reflects Management’s estimates (US$) 6

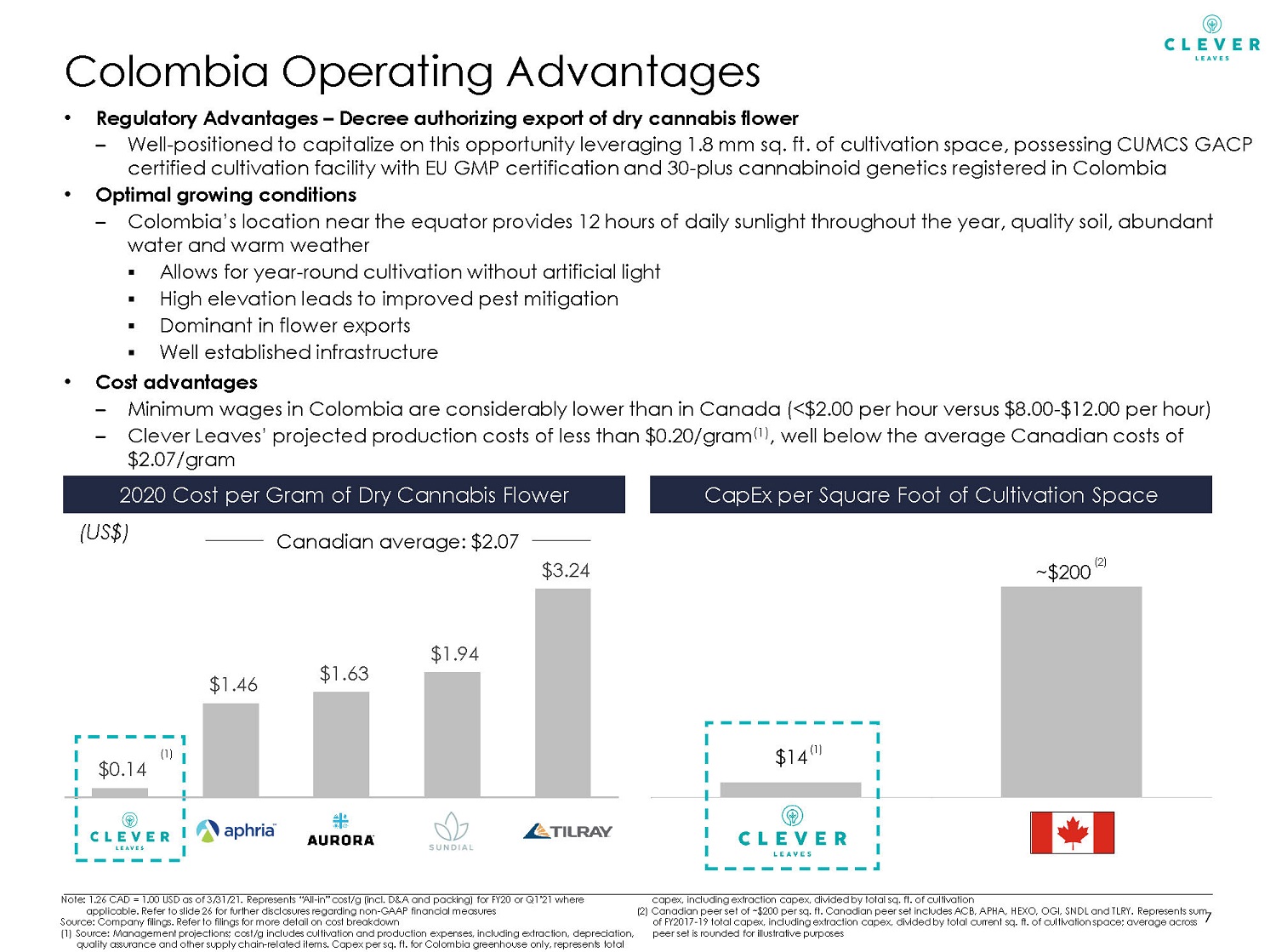

• Regulatory Advantages – Decree authorizing export of dry cannabis flower – Well - positioned to capitalize on this opportunity leveraging 1.8 mm sq. ft. of cultivation space, possessing CUMCS GACP certified cultivation facility with EU GMP certification and 30 - plus cannabinoid genetics registered in Colombia • Optimal growing conditions – Colombia’s location near the equator provides 12 hours of daily sunlight throughout the year, quality soil, abundant water and warm weather ▪ Allows for year - round cultivation without artificial light ▪ High elevation leads to improved pest mitigation ▪ Dominant in flower exports ▪ Well established infrastructure • Cost advantages – Minimum wages in Colombia are considerably lower than in Canada (<$2.00 per hour versus $8.00 - $12.00 per hour) – Clever Leaves’ projected production costs of less than $0.20/gram (1) , well below the average Canadian costs of $2.07/gram Colombia Operating Advantages 2020 Cost per Gram of Dry Cannabis Flower (US$) (1) Canadian average: $2.07 7 CapEx per Square Foot of Cultivation Space $14 ~ $200 CL Canadian Average (1) (2) $0.14 $1.46 $1.63 $1.94 $3.24 Note: 1.26 CAD = 1.00 USD as of 3/31/21. Represents “All - in” cost/g (incl. D&A and packing) for FY20 or Q1’21 where applicable. Refer to slide 26 for further disclosures regarding non - GAAP financial measures Source: Company filings. Refer to filings for more detail on cost breakdown (1) Source: Management projections; cost/g includes cultivation and production expenses, including extraction, depreciation, quality assurance and other supply chain - related items. Capex per sq. ft. for Colombia greenhouse only, represents total capex, including extraction capex, divided by total sq. ft. of cultivation (2) Canadian peer set of ~$200 per sq. ft. Canadian peer set includes ACB, APHA, HEXO, OGI, SNDL and TLRY. Represents sum of FY2017 - 19 total capex, including extraction capex, divided by total current sq. ft. of cultivation space; average across peer set is rounded for illustrative purposes

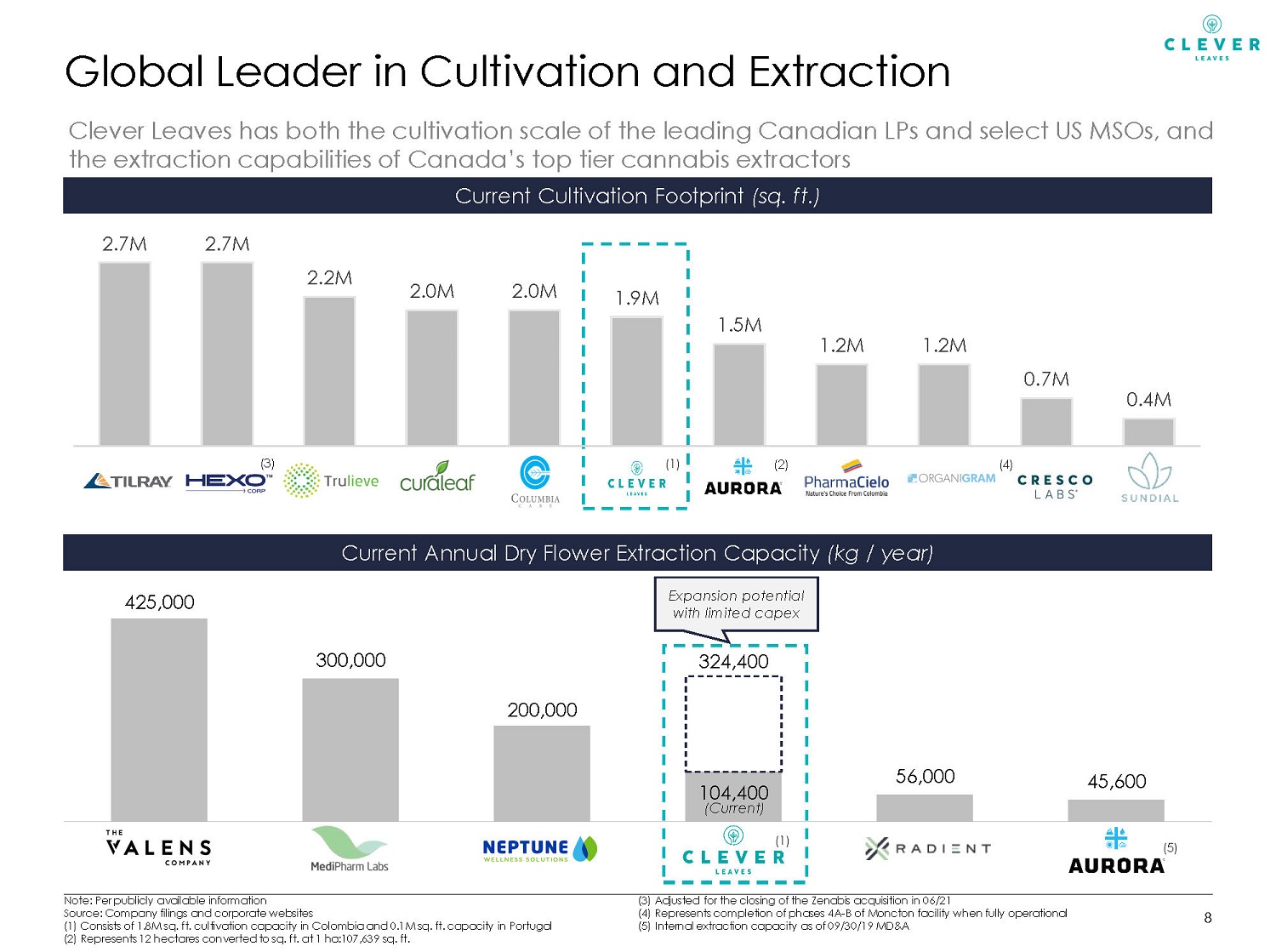

425,000 300,000 200,000 104,400 56,000 45,600 324,400 Valens Medipharm Neptune Clever Leaves Radiant Aurora Global Leader in Cultivation and Extraction Note: Per publicly available information Source: Company filings and corporate websites (1) Consists of 1.8M sq. ft. cultivation capacity in Colombia and 0.1M sq. ft. capacity in Portugal (2) Represents 12 hectares converted to sq. ft. at 1 ha:107,639 sq. ft. (3) Adjusted for the closing of the Zenabis acquisition in 06/21 (4) Represents completion of phases 4A - B of Moncton facility when fully operational (5) Internal extraction capacity as of 09/30/19 MD&A Clever Leaves has both the cultivation scale of the leading Canadian LPs and select US MSOs, and the extraction capabilities of Canada’s top tier cannabis extractors Current Cultivation Footprint (sq. ft.) Current Annual Dry Flower Extraction Capacity (kg / year) (2) (3) (Current) (5) Expansion potential with limited capex (1) (1) (4) 2.7M 2.7M 2.2M 2.0M 2.0M 1.9M 1.5M 1.2M 1.2M 0.7M 0.4M 8

EU GMP can help to unlock higher price points and creates early mover advantage EU GMP Certification Accelerates European Pharma Expansion 9 Not EU GMP - Certified (1,000’s) EU GMP - Certified Flower Producers (10+) EU GMP - Certified Vertically Integrated Botanical Extractors (<10) Clever Leaves achieved EU GMP certification in July 2020, bolstering its competitive advantage and status as a leader in the global pharmaceutical cannabis industry Note: Clever Leaves’ Colombian facilities received EU GMP certification in July 2020 Source: Company filings, EudraGMDP database, press releases, MJBiz Daily “More Canadian cannabis…EU GMP certifications” publi she d 03/09/20

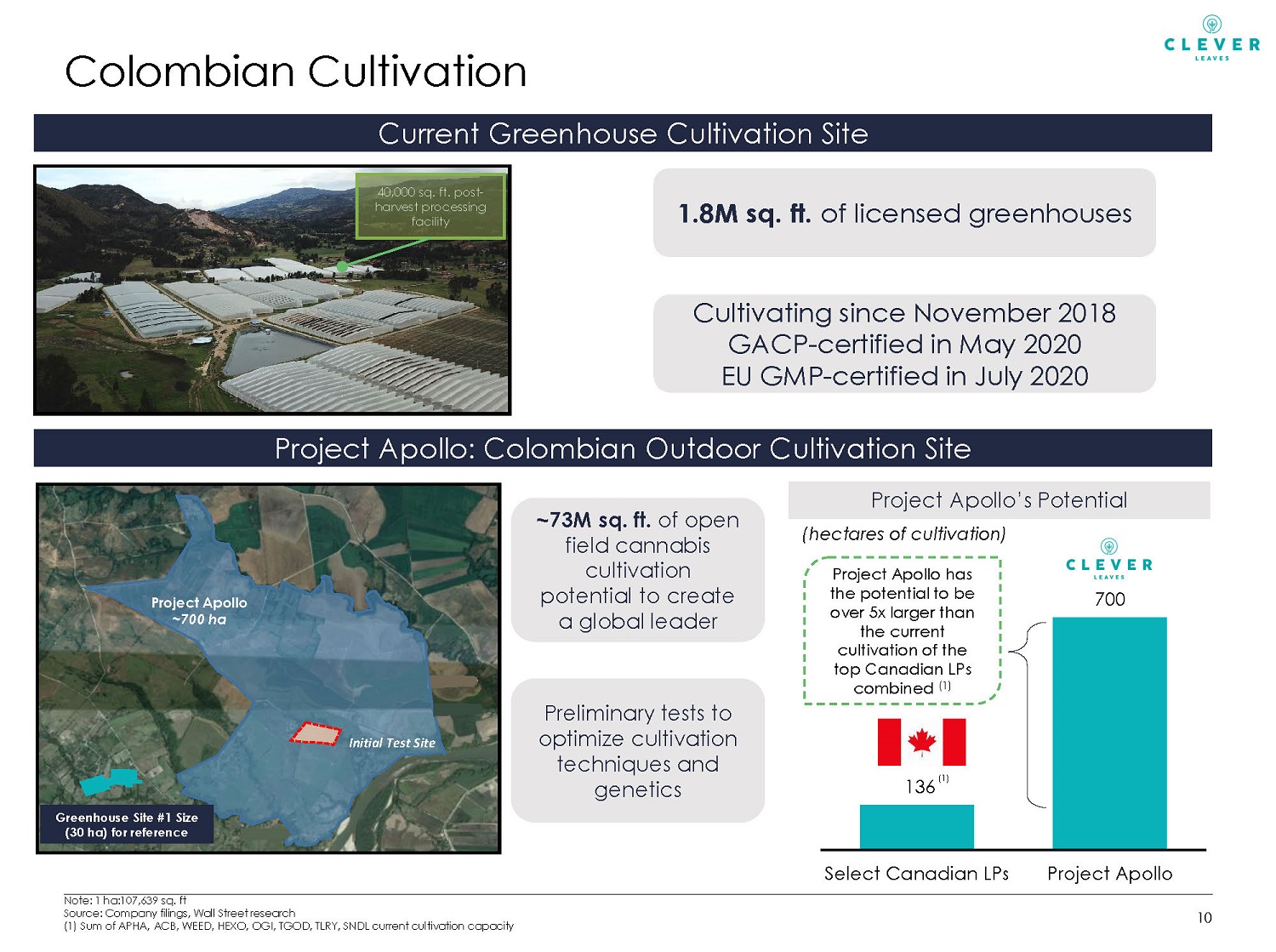

Colombian Cultivation 10 Cultivating since November 2018 GACP - certified in May 2020 EU GMP - certified in July 2020 1.8M sq. ft. of licensed greenhouses 136 700 Select Canadian LPs Project Apollo Project Apollo’s Potential (hectares of cultivation) (1) Project Apollo has the potential to be over 5x larger than the current cultivation of the top Canadian LPs combined (1) Current Greenhouse Cultivation Site Note: 1 ha:107,639 sq. ft Source: Company filings, Wall Street research (1) Sum of APHA, ACB, WEED, HEXO, OGI, TGOD, TLRY, SNDL current cultivation capacity Greenhouse Site #1 Size (30 ha) for reference Project Apollo ~700 ha Initial Test Site Project Apollo: Colombian Outdoor Cultivation Site ~73M sq. ft. of open field cannabis cultivation potential to create a global leader 40,000 sq. ft. post - harvest processing facility Preliminary tests to optimize cultivation techniques and genetics

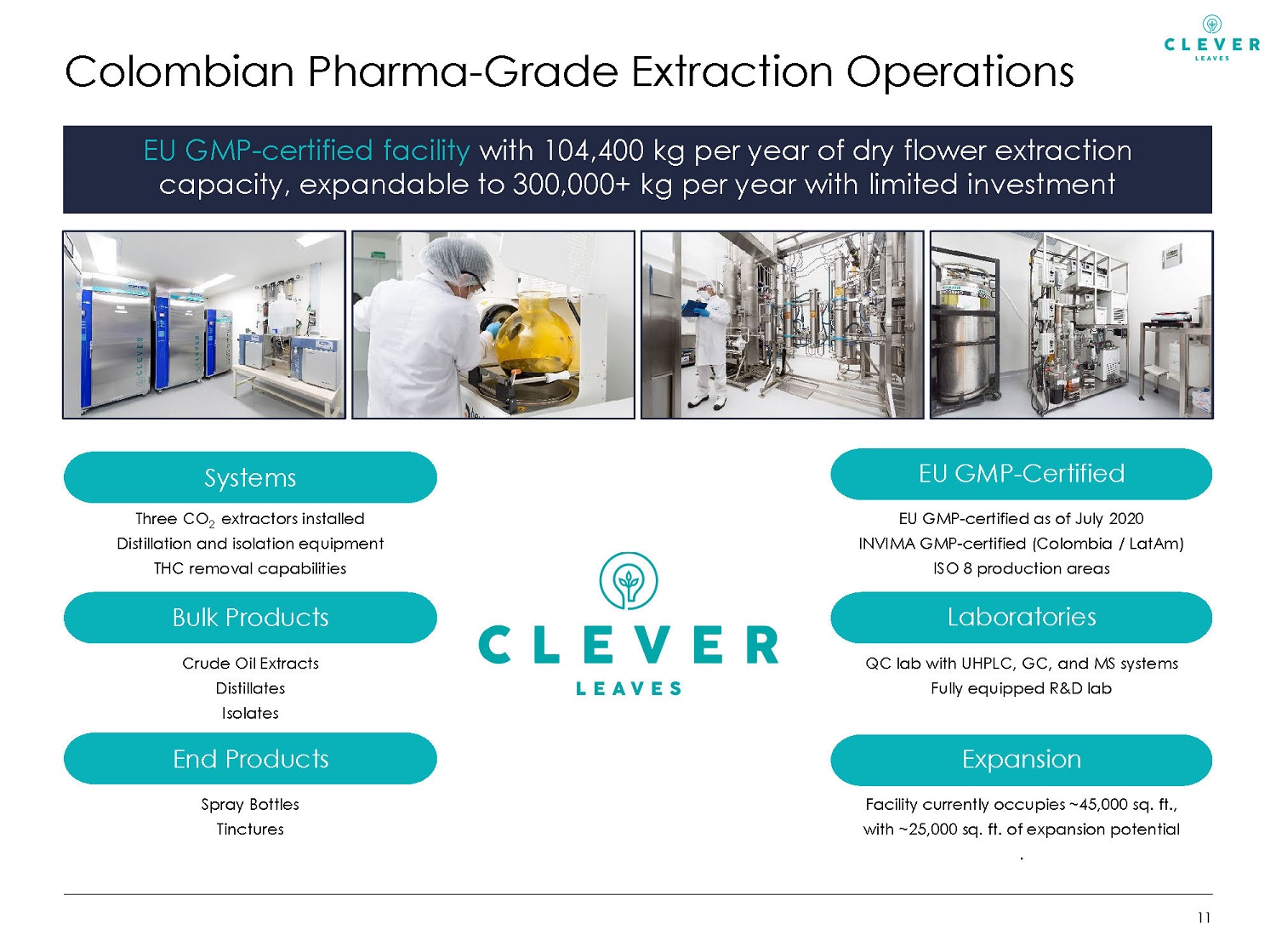

Colombian Pharma - Grade Extraction Operations Systems Bulk Products End Products Three CO 2 extractors installed Distillation and isolation equipment THC removal capabilities Crude Oil Extracts Distillates Isolates Spray Bottles Tinctures EU GMP - Certified Laboratories Expansion EU GMP - certified as of July 2020 INVIMA GMP - certified (Colombia / LatAm) ISO 8 production areas QC lab with UHPLC, GC, and MS systems Fully equipped R&D lab Facility currently occupies ~45,000 sq. ft., with ~25,000 sq. ft. of expansion potential . 11 EU GMP - certified facility with 104,400 kg per year of dry flower extraction capacity, expandable to 300,000+ kg per year with limited investment

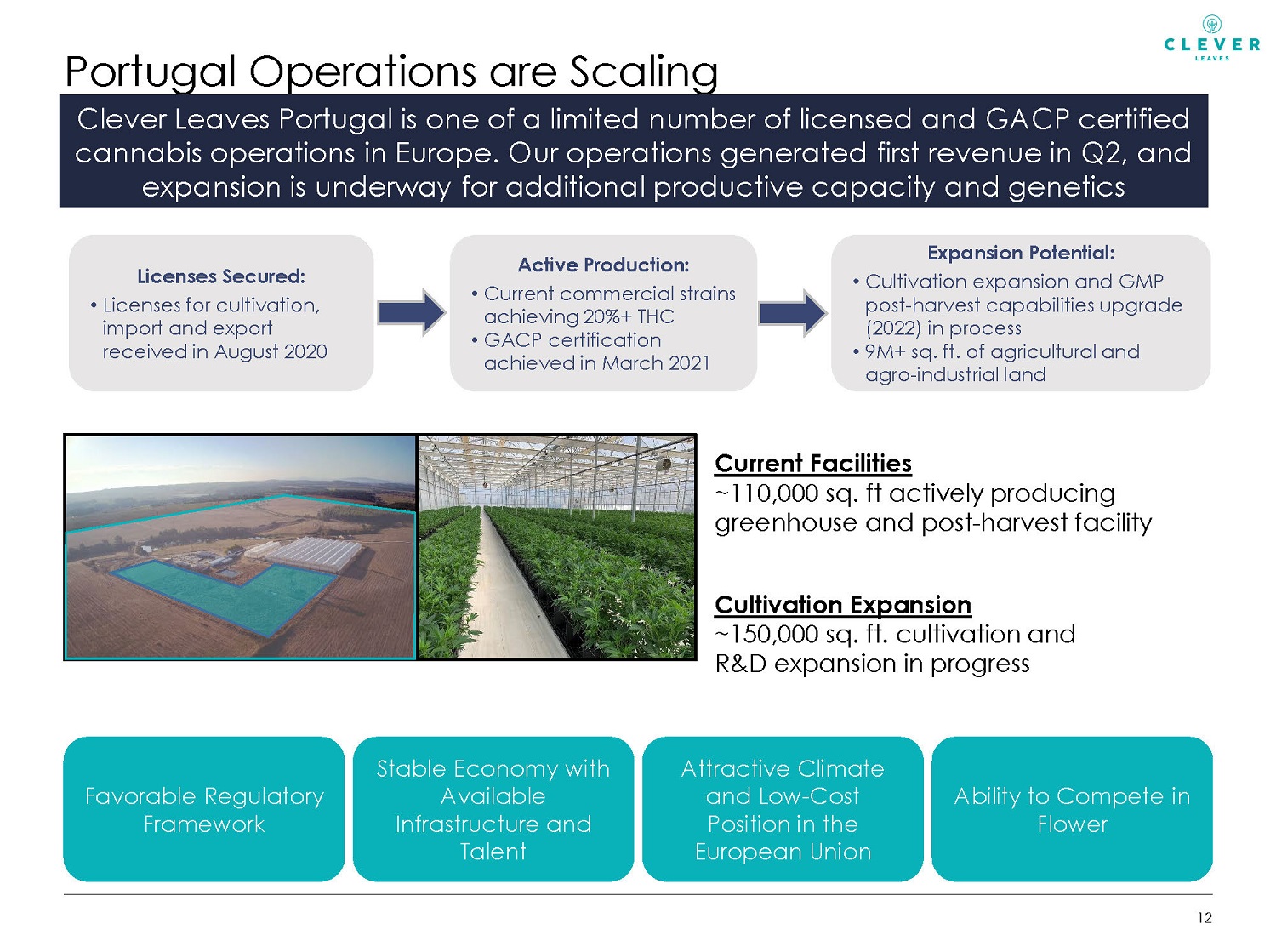

Portugal Operations are Scaling 12 Clever Leaves Portugal is one of a limited number of licensed and GACP certified cannabis operations in Europe. Our operations generated first revenue in Q2, and expansion is underway for additional productive capacity and genetics capabilities Favorable Regulatory Framework Attractive Climate and Low - Cost Position in the European Union Stable Economy with Available Infrastructure and Talent Ability to Compete in Flower Current Facilities ~110,000 sq. ft actively producing greenhouse and post - harvest facility Cultivation Expansion ~150,000 sq. ft. cultivation and R&D expansion in progress Expansion Potential: • Cultivation expansion and GMP post - harvest capabilities upgrade (2022) in process • 9M+ sq. ft. of agricultural and agro - industrial land Active Production: • Current commercial strains achieving 20%+ THC • GACP certification achieved in March 2021 Licenses Secured: • Licenses for cultivation, import and export received in August 2020

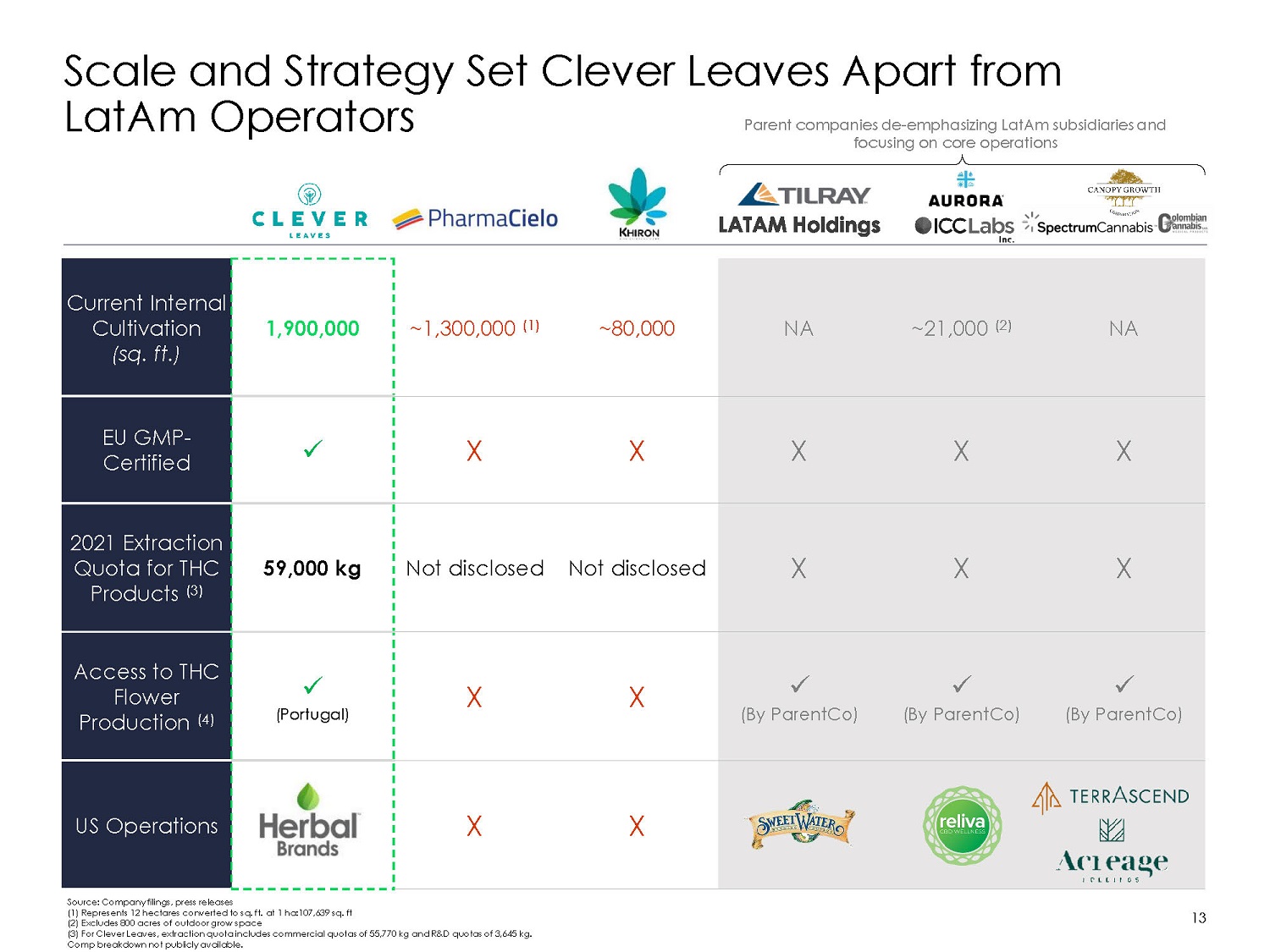

Current Internal Cultivation (sq. ft.) 1,900,000 ~1,300,000 (1) ~80,000 NA ~21,000 (2) NA EU GMP - Certified x X X X X X 2021 Extraction Quota for THC Products (3) 59,000 kg Not disclosed Not disclosed X X X Access to THC Flower Production (4) x (Portugal) X X x (By ParentCo ) x (By ParentCo ) x (By ParentCo ) US Operations X X Scale and Strategy Set Clever Leaves Apart from LatAm Operators Parent companies de - emphasizing LatAm subsidiaries and focusing on core operations Source: Company filings, press releases (1) Represents 12 hectares converted to sq. ft. at 1 ha:107,639 sq. ft (2) Excludes 800 acres of outdoor grow space (3) For Clever Leaves, extraction quota includes commercial quotas of 55,770 kg and R&D quotas of 3,645 kg. Comp breakdown not publicly available. 13

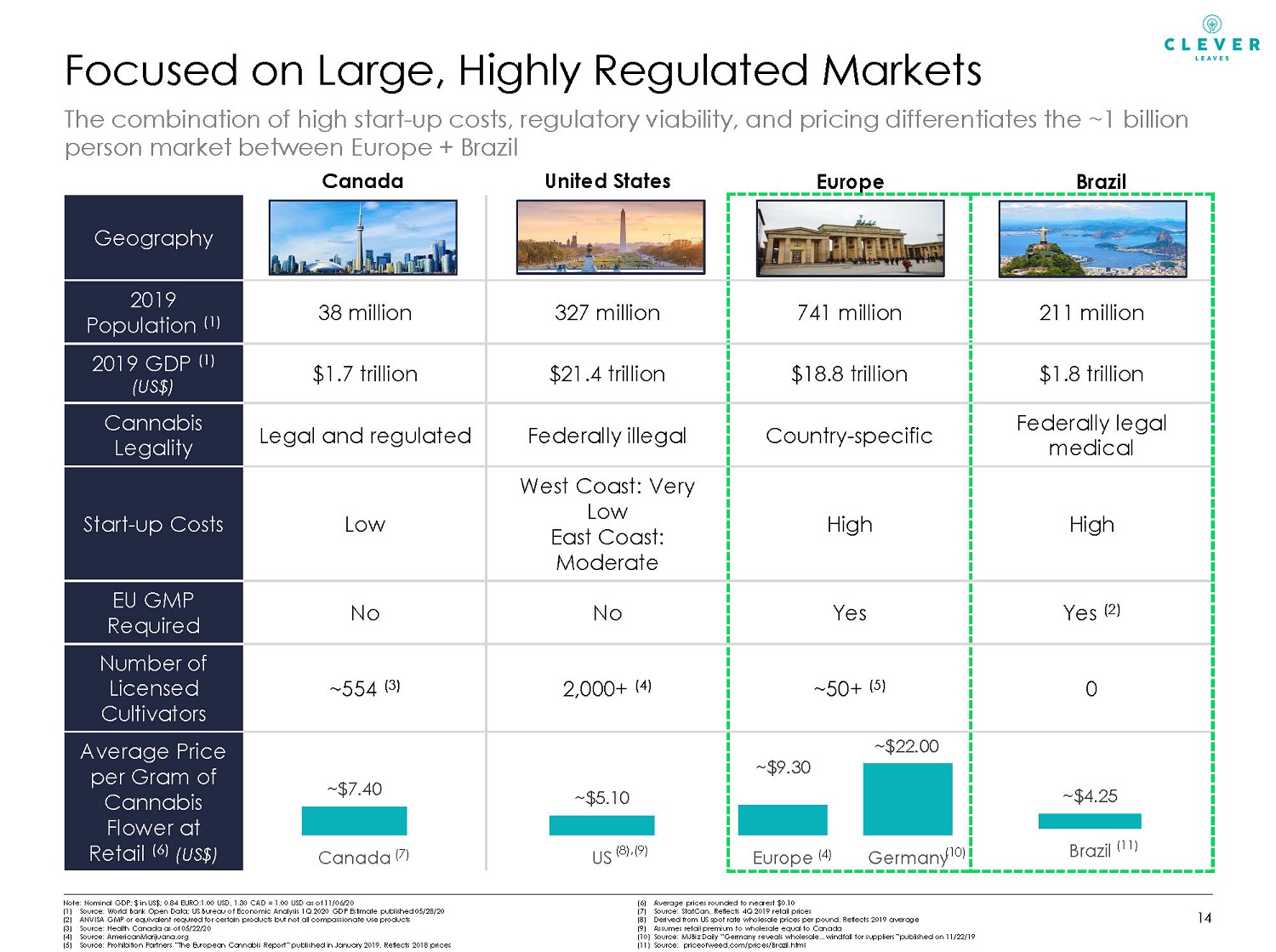

Geography 2019 Population (1) 38 million 327 million 741 million 211 million 2019 GDP (1) (US$) $1.7 trillion $21.4 trillion $18.8 trillion $1.8 trillion Cannabis Legality Legal and regulated Federally illegal Country - specific Federally legal medical Start - up Costs Low West Coast: Very Low East Coast: Moderate High High EU GMP Required No No Yes Yes (2) Number of Licensed Cultivators ~554 (3) 2,000+ (4) ~50+ (5) 0 Average Price per Gram of Cannabis Flower at Retail (6) (US$) Note: Nominal GDP; $ in US$; 0.84 EURO:1.00 USD, 1.30 CAD = 1.00 USD as of 11/06/20 (1) Source: World Bank Open Data; US Bureau of Economic Analysis 1Q 2020 GDP Estimate published 05/28/20 (2) ANVISA GMP or equivalent required for certain products but not all compassionate use products (3) Source: Health Canada as of 05/22/20 (4) Source: AmericanMarijuana.org (5) Source: Prohibition Partners “The European Cannabis Report” published in January 2019. Reflects 2018 prices (6) Average prices rounded to nearest $0.10 (7) Source: StatCan. Reflects 4Q 2019 retail prices (8) Derived from US spot rate wholesale prices per pound. Reflects 2019 average (9) Assumes retail premium to wholesale equal to Canada (10) Source: MJBiz Daily “Germany reveals wholesale…windfall for suppliers” published on 11/22/19 (11) Source: priceofweed.com/prices/Brazil.html Europe United States Canada (8),(9) Focused on Large, Highly Regulated Markets (7) (4) (10) The combination of high start - up costs, regulatory viability, and pricing differentiates the ~1 billion person market between Europe + Brazil 14 ~ $7.40 ~$5.10 Canada US ~ $9.30 ~ $22.00 Europe Germany Brazil ~ $4.25 Brazil (11)

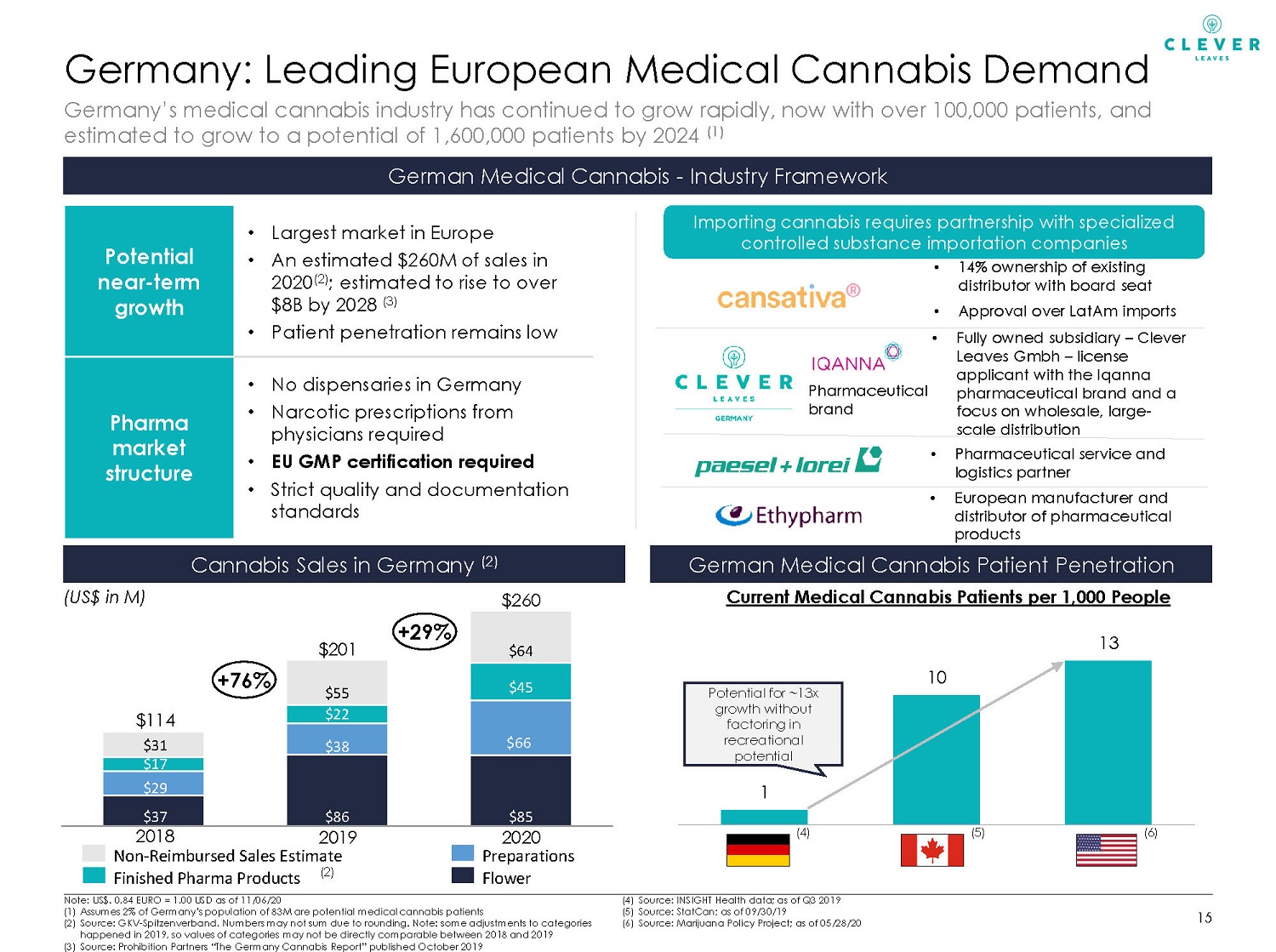

1 10 13 Germany Canada US Germany: Leading European Medical Cannabis Demand 15 Note: US$. 0.84 EURO = 1.00 USD as of 11/06/20 (1) Assumes 2% of Germany’s population of 83M are potential medical cannabis patients (2) Source: GKV - Spitzenverband . Numbers may not sum due to rounding. Note: some adjustments to categories happened in 2019, so values of categories may not be directly comparable between 2018 and 2019 (3) Source: Prohibition Partners “The Germany Cannabis Report” published October 2019 (4) Source: INSIGHT Health data; as of Q3 2019 (5) Source: StatCan ; as of 09/30/19 (6) Source: Marijuana Policy Project; as of 05/28/20 German Medical Cannabis - Industry Framework Cannabis Sales in Germany (2) Germany’s medical cannabis industry has continued to grow rapidly, now with over 100,000 patients, and estimated to grow to a potential of 1,600,000 patients by 2024 (1) Potential near - term growth • Largest market in Europe • An estimated $260M of sales in 2020 (2) ; estimated to rise to over $8B by 2028 (3) • Patient penetration remains low Pharma market structure • No dispensaries in Germany • Narcotic prescriptions from physicians required • EU GMP certification required • Strict quality and documentation standards (US$ in M) German Medical Cannabis Patient Penetration Current Medical Cannabis Patients per 1,000 People (4) (6) (5) (2) Potential for ~13x growth without factoring in recreational potential • 14% ownership of existing distributor with board seat • Approval over LatAm imports • Fully owned subsidiary – Clever Leaves Gmbh – license applicant with the Iqanna pharmaceutical brand and a focus on wholesale, large - scale distribution Importing cannabis requires partnership with specialized controlled substance importation companies • Pharmaceutical service and logistics partner • European manufacturer and distributor of pharmaceutical products Pharmaceutical brand $37 $86 $85 $29 $38 $66 $17 $22 $45 $31 $55 $64 $ 260 2020 2018 2019 $ 114 $ 201 +76% Non - Reimbursed Sales Estimate Flower Finished Pharma Products Preparations +29%

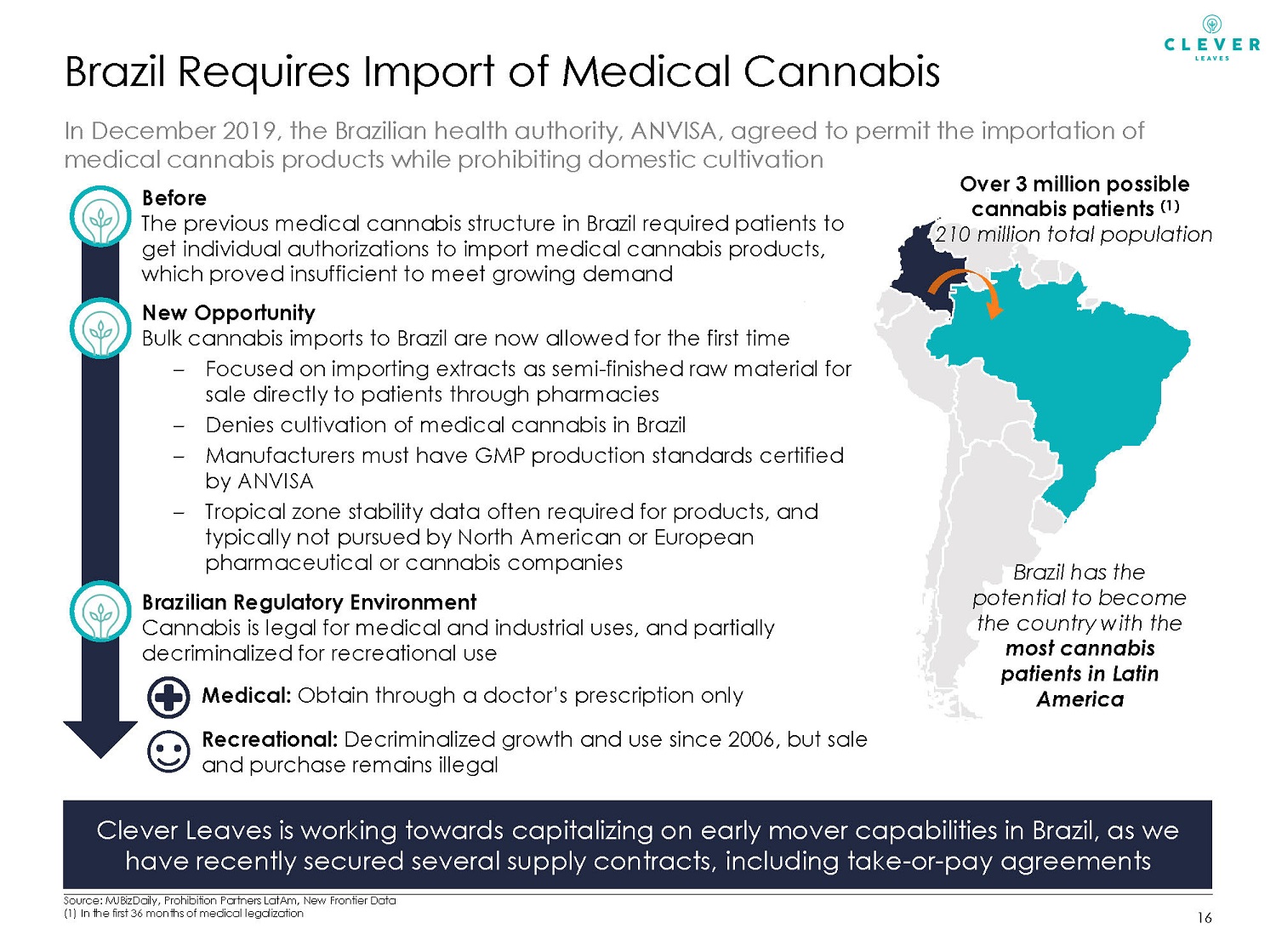

Brazil Requires Import of Medical Cannabis 16 In December 2019, the Brazilian health authority, ANVISA, agreed to permit the importation of medical cannabis products while prohibiting domestic cultivation Before The previous medical cannabis structure in Brazil required patients to get individual authorizations to import medical cannabis products, which proved insufficient to meet growing demand Source: MJBizDaily, Prohibition Partners LatAm, New Frontier Data (1) In the first 36 months of medical legalization New Opportunity Bulk cannabis imports to Brazil are now allowed for the first time – Focused on importing extracts as semi - finished raw material for sale directly to patients through pharmacies – Denies cultivation of medical cannabis in Brazil – Manufacturers must have GMP production standards certified by ANVISA – Tropical zone stability data often required for products, and typically not pursued by North American or European pharmaceutical or cannabis companies Clever Leaves is working towards capitalizing on early mover capabilities in Brazil, as we have recently secured several supply contracts, including take - or - pay agreements Brazilian Regulatory Environment Cannabis is legal for medical and industrial uses, and partially decriminalized for recreational use Brazil has the potential to become the country with the most cannabis patients in Latin America Medical: Obtain through a doctor’s prescription only Recreational: Decriminalized growth and use since 2006, but sale and purchase remains illegal Over 3 million possible cannabis patients (1) 210 million total population

Herbal Brands Overview 17 • 30 - year brand history – Positioned as an active lifestyle line for active users – Control all aspects of products and distribution • 45+ employees, including sales, marketing, and product development, manufacturing – GMP manufacturing center in Tempe, AZ – Sales reps throughout the US – Call center/inside sales reps located in Paris, TN • Nationwide distribution across US through four primary selling channels, providing access to ~15,000+ locations: – Traditional mass retailers (Walgreens, CVS) – Health food chains (GNC, Vitamin World, Vitamin Shoppe) – Smoke Shops (specialty stores that serve the cannabis and related industries) – Online retailers (Amazon and direct to consumer) • Began importing CBD from Colombia to the US in Q1’21 – Initial CBD brand launch for targeted for Q4’ 21 – Q1’22 High Quality National Customer Base (Sign on after CLVR acquisition) To enhance access to the US market and secure relationships with potential key distribution partners, in 2019, Clever Leaves acquired a branded nutraceutical company and rebranded it as Herbal Brands .

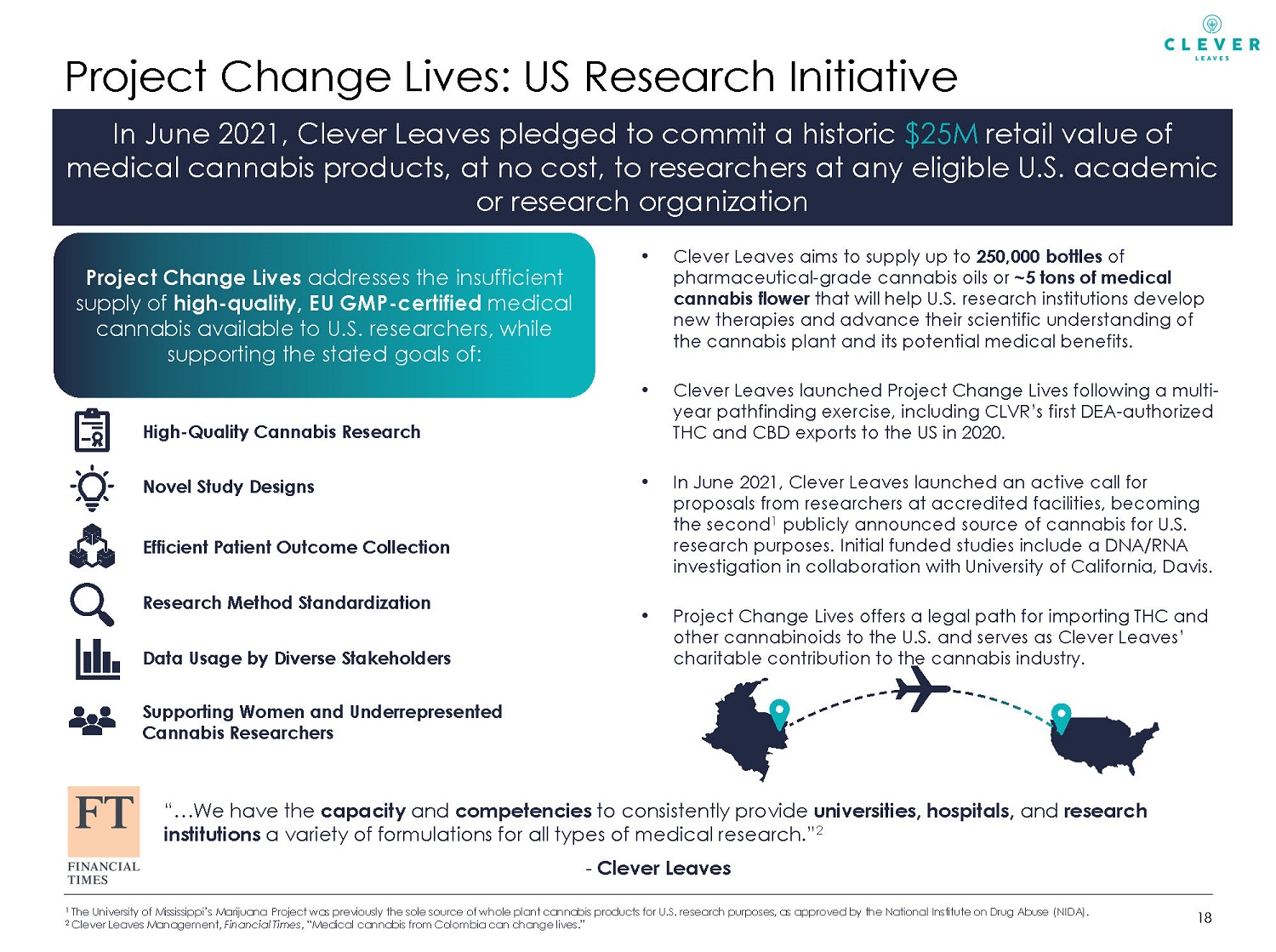

Project Change Lives: US Research Initiative 18 In June 2021, Clever Leaves pledged to commit a historic $25M retail value of medical cannabis products, at no cost, to researchers at any eligible U.S. academic or research organization • Clever Leaves aims to supply up to 250,000 bottles of pharmaceutical - grade cannabis oils or ~5 tons of medical cannabis flower that will help U.S. research institutions develop new therapies and advance their scientific understanding of the cannabis plant and its potential medical benefits. • Clever Leaves launched Project Change Lives following a multi - year pathfinding exercise, including CLVR’s first DEA - authorized THC and CBD exports to the US in 2020. • In June 2021, Clever Leaves launched an active call for proposals from researchers at accredited facilities, becoming the second 1 publicly announced source of cannabis for U.S. research purposes. Initial funded studies include a DNA/RNA investigation in collaboration with University of California, Davis. • Project Change Lives offers a legal path for importing THC and other cannabinoids to the U.S. and serves as Clever Leaves’ charitable contribution to the cannabis industry. “…We have the capacity and competencies to consistently provide universities, hospitals, and research institutions a variety of formulations for all types of medical research.” 2 - Clever Leaves 1 The University of Mississippi’s Marijuana Project was previously the sole source of whole plant cannabis products for U.S. re sea rch purposes, as approved by the National Institute on Drug Abuse (NIDA). 2 Clever Leaves Management, Financial Times , “Medical cannabis from Colombia can change lives.” Project Change Lives addresses the insufficient supply of high - quality, EU GMP - certified medical cannabis available to U.S. researchers, while supporting the stated goals of: High - Quality Cannabis Research Novel Study Designs Efficient Patient Outcome Collection Research Method Standardization Supporting Women and Underrepresented Cannabis Researchers Data Usage by Diverse Stakeholders

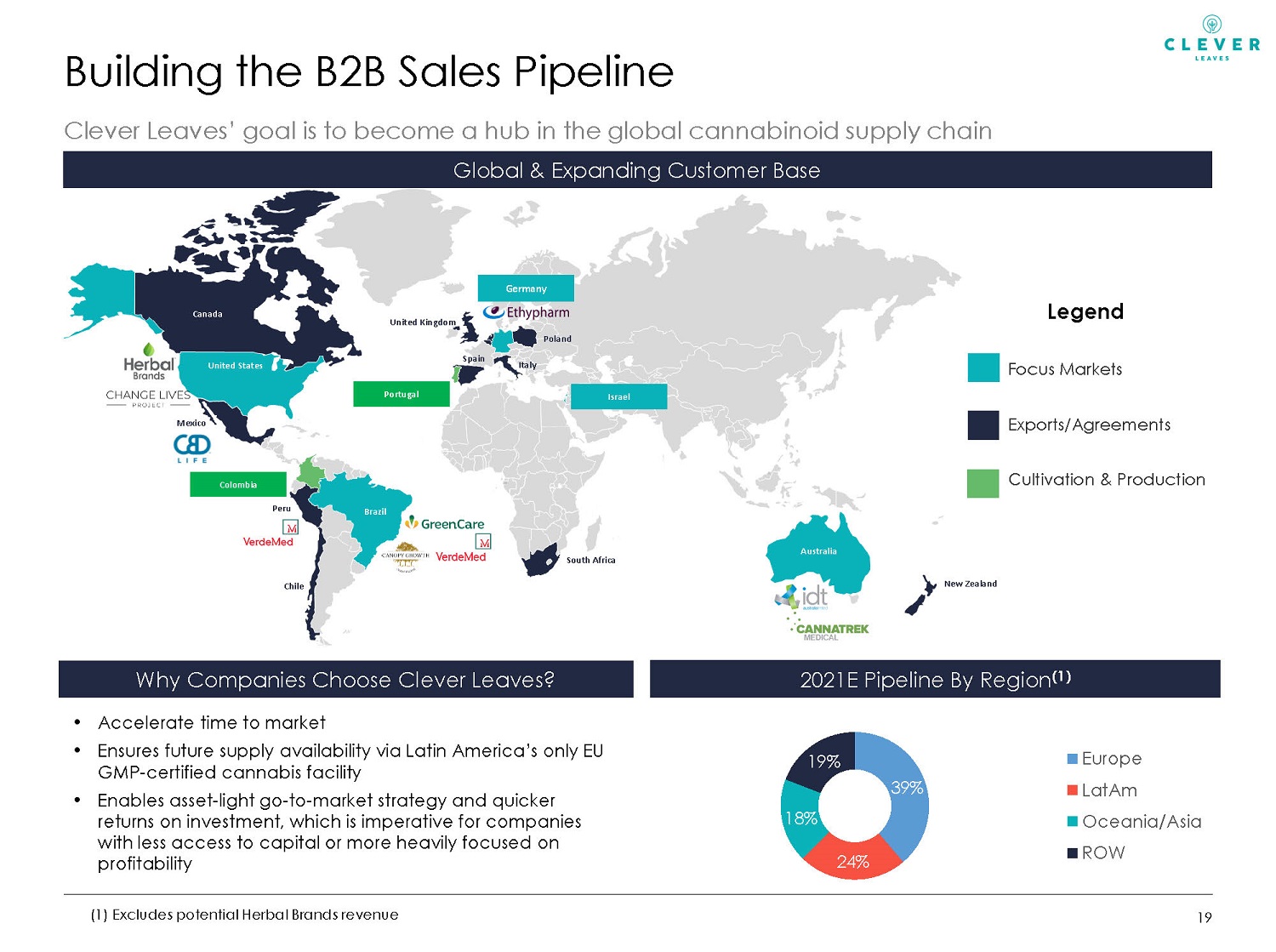

Building the B2B Sales Pipeline Clever Leaves’ goal is to become a hub in the global cannabinoid supply chain 19 2021E Pipeline By Region (1) • Accelerate time to market • Ensures future supply availability via Latin America’s only EU GMP - certified cannabis facility • Enables asset - light go - to - market strategy and quicker returns on investment, which is imperative for companies with less access to capital or more heavily focused on profitability Why Companies Choose Clever Leaves? Global & Expanding Customer Base (1) Excludes potential Herbal Brands revenue 39% 24% 18% 19% Europe LatAm Oceania/Asia ROW United Kingdom Germany Legend Focus Markets Exports/Agreements Cultivation & Production Canada United States Mexico Peru Chile Brazil Spain Poland South Africa Italy Israel New Zealand Australia Portugal Colombia

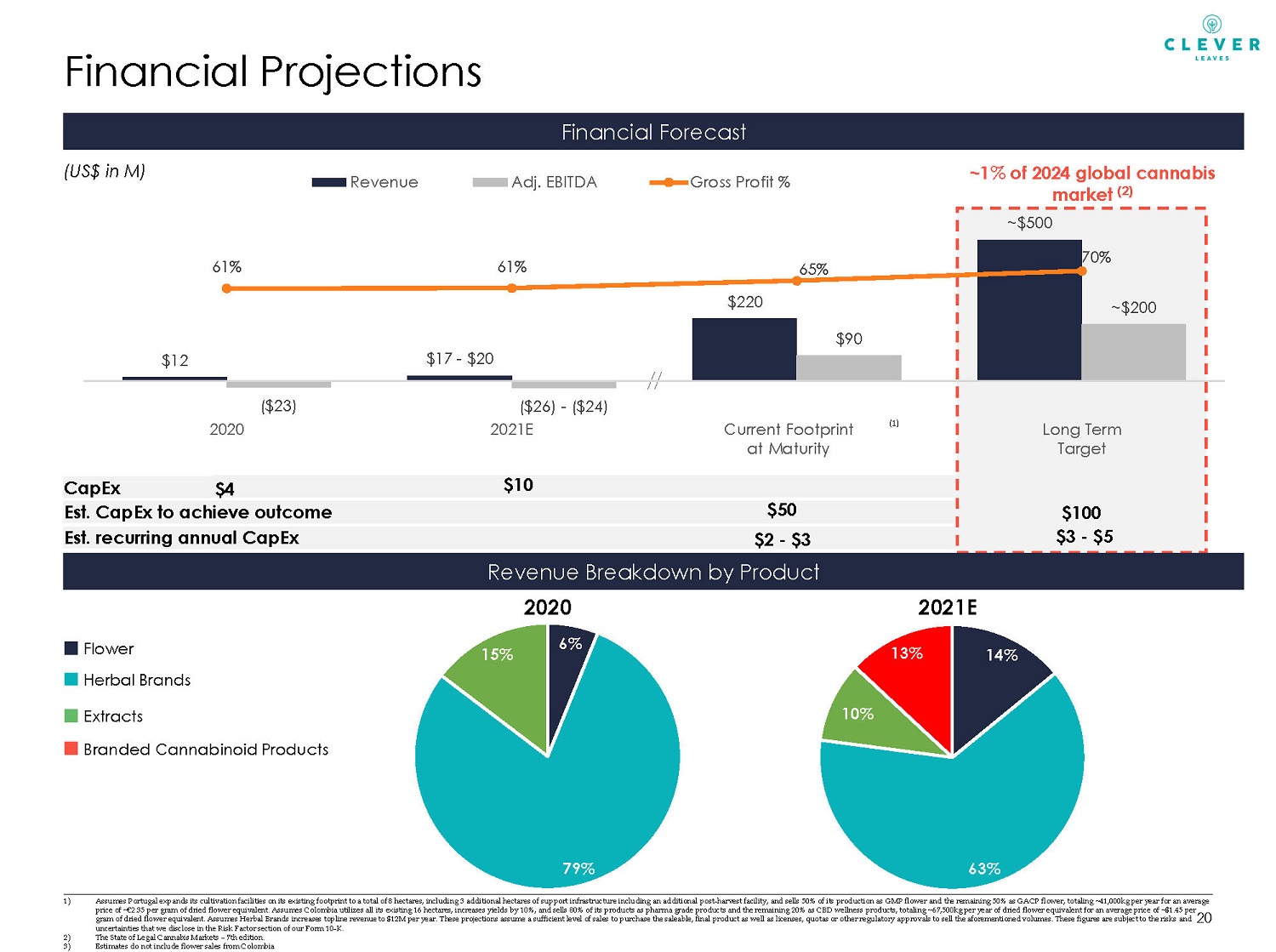

Financial Projections Financial Forecast Revenue Breakdown by Product 20 (US$ in M) CapEx Flower Herbal Brands Extracts Branded Cannabinoid Products 2021E 2020 $100 1) Assumes Portugal expands its cultivation facilities on its existing footprint to a total of 8 hectares, including 3 additiona l h ectares of support infrastructure including an additional post - harvest facility, and sells 50% of its production as GMP flower a nd the remaining 50% as GACP flower, totaling ~41,000kg per year for an average price of ~€2.35 per gram of dried flower equivalent. Assumes Colombia utilizes all its existing 16 hectares, increases yields by 10%, and sells 80% of its products as pharma grade products and the remaining 20% as CBD wellness products, totaling ~67,500k g per year of dried flower equivalent for an average price of ~$1.45 per gram of dried flower equivalent. Assumes Herbal Brands increases topline revenue to $12M per year. These projections assume a su fficient level of sales to purchase the saleable, final product as well as licenses, quotas or other regulatory approvals to sel l the aforementioned volumes. These figures are subject to the risks and uncertainties that we disclose in the Risk Factor section of our Form 10 - K. 2) The State of Legal Cannabis Markets – 7th edition. 3) Estimates do not include flower sales from Colombia Est. CapEx to achieve outcome Est. recurring annual CapEx $4 $3 - $5 $2 - $3 $50 (1) $10 6% 79% 15% 14% 63% 10% 13% $12 $17 - $20 $220 ~ $500 ($23) ($26) - ($24) $90 ~$200 61% 61% 65% 70% 2020 2021E Current Footprint at Maturity Long Term Target Revenue Adj. EBITDA Gross Profit % ~1% of 2024 global cannabis market (2)

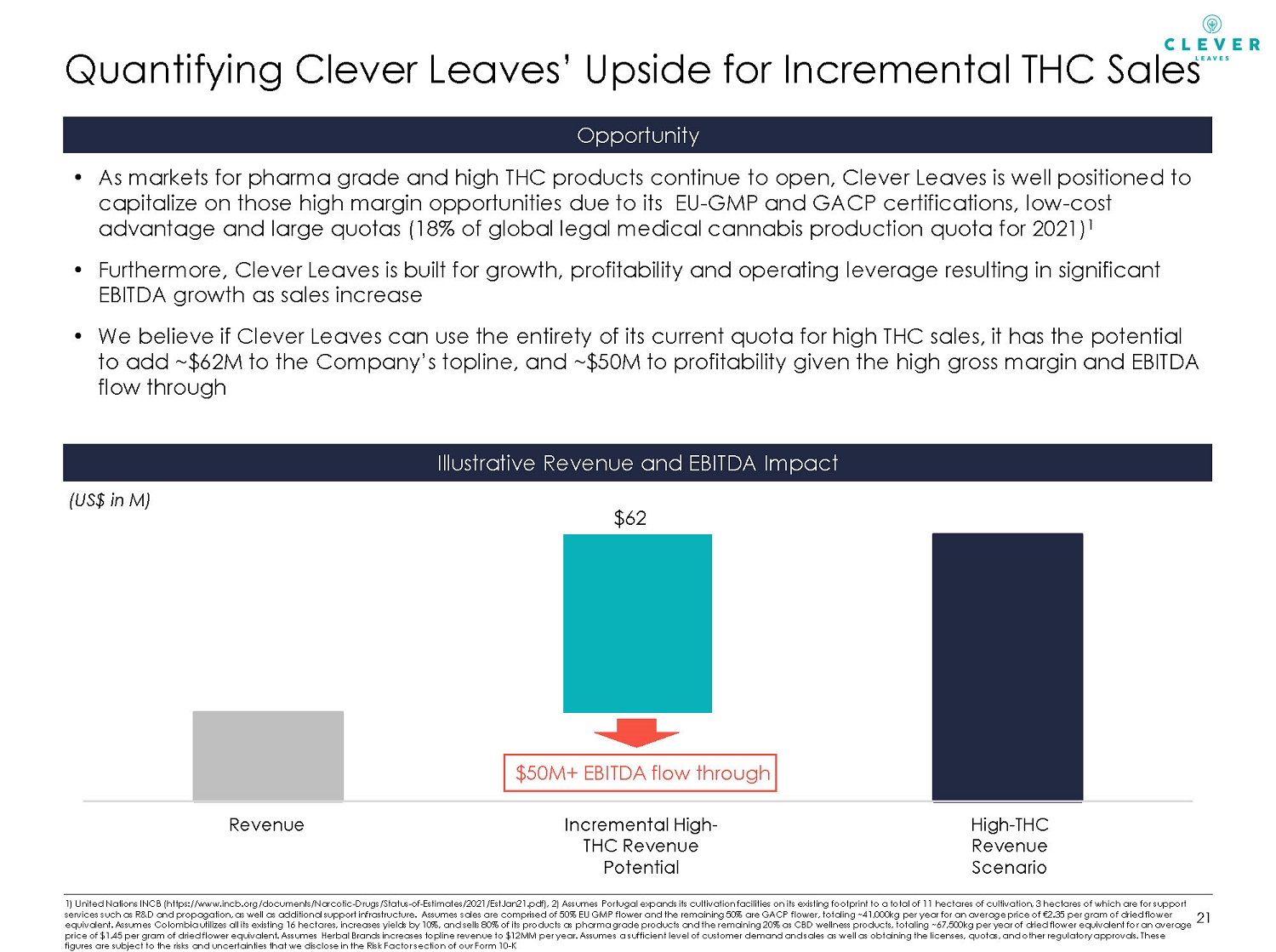

Quantifying Clever Leaves’ Upside for Incremental THC Sales 1) United Nations INCB (https://www.incb.org/documents/Narcotic - Drugs/Status - of - Estimates/2021/EstJan21.pdf), 2) Assumes Portuga l expands its cultivation facilities on its existing footprint to a total of 11 hectares of cultivation, 3 hectares of which are for support services such as R&D and propagation, as well as additional support infrastructure. Assumes sales are comprised of 50% EU GM P f lower and the remaining 50% are GACP flower, totaling ~41,000kg per year for an average price of €2.35 per gram of dried flow er equivalent. Assumes Colombia utilizes all its existing 16 hectares, increases yields by 10%, and sells 80% of its products as ph arma grade products and the remaining 20% as CBD wellness products, totaling ~67,500kg per year of dried flower equivalent fo r a n average price of $1.45 per gram of dried flower equivalent. Assumes Herbal Brands increases topline revenue to $12MM per year. Assume s a sufficient level of customer demand and sales as well as obtaining the licenses, quotas, and other regulatory approvals. Thes e figures are subject to the risks and uncertainties that we disclose in the Risk Factor section of our Form 10 - K Opportunity 21 Illustrative Revenue and EBITDA Impact (US$ in M) • As markets for pharma grade and high THC products continue to open, Clever Leaves is well positioned to capitalize on those high margin opportunities due to its EU - GMP and GACP certifications, low - cost advantage and large quotas (18% of global legal medical cannabis production quota for 2021) 1 • Furthermore, Clever Leaves is built for growth, profitability and operating leverage resulting in significant EBITDA growth as sales increase • We believe if Clever Leaves can use the entirety of its current quota for high THC sales, it has the potential to add ~$62M to the Company’s topline, and ~$50M to profitability given the high gross margin and EBITDA flow through Revenue Incremental High - THC Revenue Potential High - THC Revenue Scenario $62 $50M+ EBITDA flow through

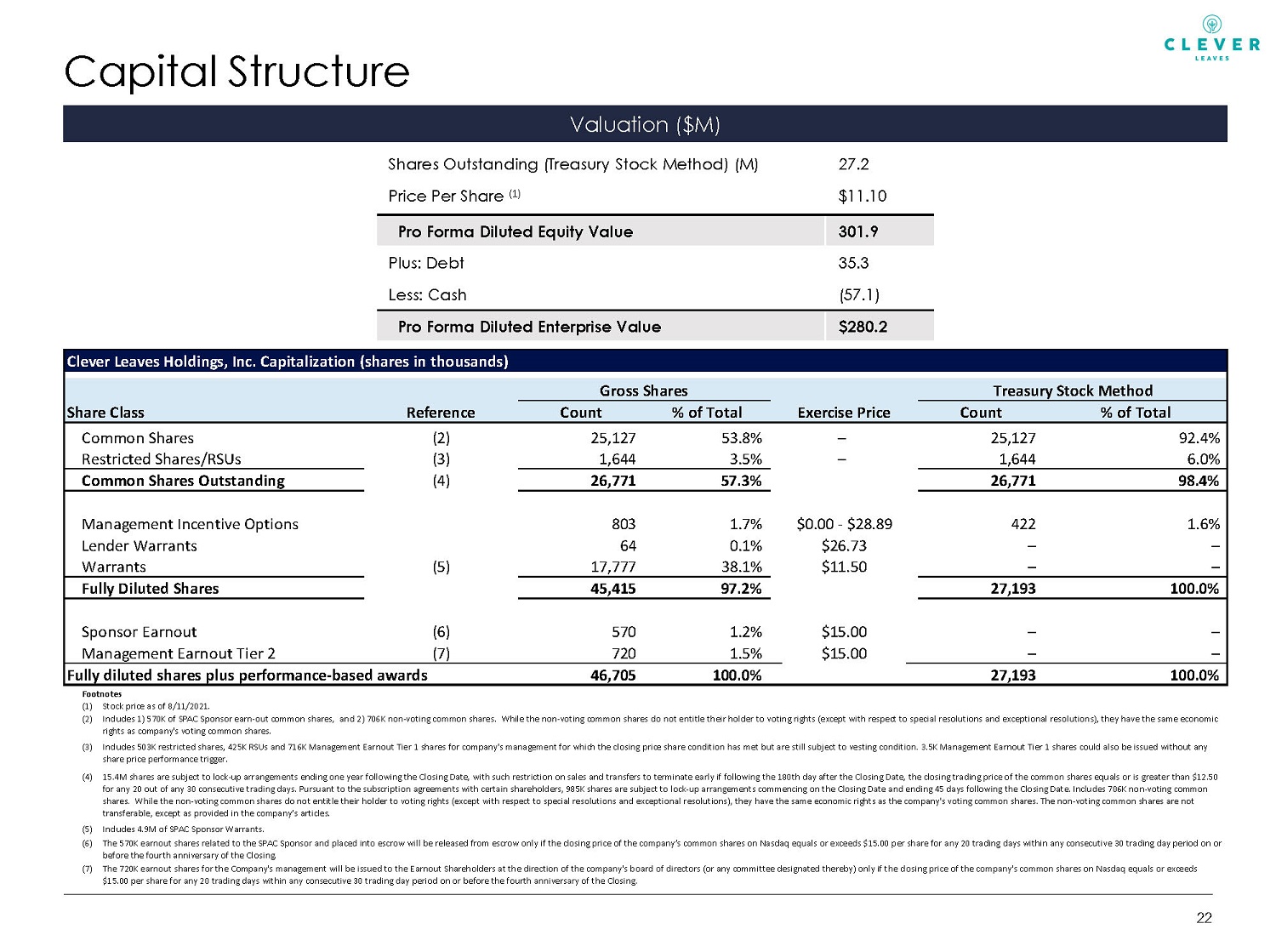

Capital Structure Valuation ($M) 22 Shares Outstanding (Treasury Stock Method) (M) 27.2 Price Per Share (1) $11.10 Pro Forma Diluted Equity Value 301.9 Plus: Debt 35.3 Less: Cash (57.1) Pro Forma Diluted Enterprise Value $280.2 Clever Leaves Holdings, Inc. Capitalization (shares in thousands) Gross Shares Treasury Stock Method Share Class Reference Count % of Total Exercise Price Count % of Total Common Shares (2) 25,127 53.8% – 25,127 92.4% Restricted Shares/RSUs (3) 1,644 3.5% – 1,644 6.0% Common Shares Outstanding (4) 26,771 57.3% 26,771 98.4% Management Incentive Options 803 1.7% $0.00 - $28.89 422 1.6% Lender Warrants 64 0.1% $26.73 – – Warrants (5) 17,777 38.1% $11.50 – – Fully Diluted Shares 45,415 97.2% 27,193 100.0% Sponsor Earnout (6) 570 1.2% $15.00 – – Management Earnout Tier 2 (7) 720 1.5% $15.00 – – Fully diluted shares plus performance-based awards 46,705 100.0% 27,193 100.0% Footnotes (1) (2) (3) (4) (5) Includes 4.9M of SPAC Sponsor Warrants. (6) (7) The 720K earnout shares for the Company's management will be issued to the Earnout Shareholders at the direction of the company's board of directors (or any committee designated thereby) only if the closing price of the company's common shares on Nasdaq equals or exceeds $15.00 per share for any 20 trading days within any consecutive 30 trading day period on or before the fourth anniversary of the Closing. Stock price as of 8/11/2021. Includes 1) 570K of SPAC Sponsor earn-out common shares, and 2) 706K non-voting common shares. While the non-voting common shares do not entitle their holder to voting rights (except with respect to special resolutions and exceptional resolutions), they have the same economic rights as company's voting common shares. Includes 503K restricted shares, 425K RSUs and 716K Management Earnout Tier 1 shares for company's management for which the closing price share condition has met but are still subject to vesting condition. 3.5K Management Earnout Tier 1 shares could also be issued without any share price performance trigger. 15.4M shares are subject to lock-up arrangements ending one year following the Closing Date, with such restriction on sales and transfers to terminate early if following the 180th day after the Closing Date, the closing trading price of the common shares equals or is greater than $12.50 for any 20 out of any 30 consecutive trading days. Pursuant to the subscription agreements with certain shareholders, 985K shares are subject to lock-up arrangements commencing on the Closing Date and ending 45 days following the Closing Date. Includes 706K non-voting common shares. While the non-voting common shares do not entitle their holder to voting rights (except with respect to special resolutions and exceptional resolutions), they have the same economic rights as the company's voting common shares. The non-voting common shares are not transferable, except as provided in the company’s articles. The 570K earnout shares related to the SPAC Sponsor and placed into escrow will be released from escrow only if the closing price of the company’s common shares on Nasdaq equals or exceeds $15.00 per share for any 20 trading days within any consecutive 30 trading day period on or before the fourth anniversary of the Closing.

Andrés Fajardo Director and President Gary Julien Independent Director Hank Hague Chief Financial Officer Etienne Deffarges Independent Director Julián Wilches Chief Regulatory Officer Kyle Detwiler Chairman and Chief Executive Officer Fmr. Senate Majority Leader Tom Daschle Advisory Board Member Key Leadership World - class leadership with a track record of outstanding execution leading a 477 - person team David Kastin General Counsel Schultze Asset Management, LP Elisabeth DeMarse Independent Director Clever Leaves Executives 23 (1) As of Dec 31, 2020.

Investment Highlights 24 3 Pharmaceutical - grade, EU GMP - certified production authorized for export 2 Thoughtfully constructed, B2B focused multi - national operator 4 Positioned for significant growth, profitability and operating leverage 5 Talented and experienced leadership with operational and regulatory expertise 1 Leader in low - cost medical - focused cannabis cultivation and extraction 6 Strong balance sheet with ~$57M in cash 7 NASDAQ listing and US GAAP financials

Contact Clever Leaves Hank Hague Chief Financial Officer hank.hague@cleverleaves.com Investor Relations Cody Slach or Jackie Keshner Gateway IR CLVR@gatewayir.com (949) 574 - 3860

Disclaimer No Representations or Warranties This presentation (this “Presentation”) is provided for informational purposes only. No representations or warranties, expre ss or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will Clever Leaves Holdings Inc. (“Clever Leaves”) or any of its subsidia rie s, shareholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of pr ofi t arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in conn ect ion therewith. Industry and market data used in this Presentation have been obtained from third - party industry publications and source as well as from research reports prepared for other purpose s. Clever Leaves has not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In add ition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Clever Leaves. Viewers of this Presentation sh ould each make their own evaluation of Clever Leaves and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. No Offer or Solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of s ecu rities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Forward - Looking Statements This presentation includes certain statements that are not historical facts but are forward - looking statements for purposes of t he safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “aim,” “anticipate,” “belie ve,” “can,” “continue,” “could,” “estimate,” “evolve,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “opportunity,” “outlook,” “pipeline,” “plan,” “predict,” “potent ial ,” “projected,” “seek,” “seem,” “should,” “will,” “would” and similar expressions (or the negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. Such forward - looking statements as well as our outlook for 2021 and beyond, including our financial forecast at maturity and our long - term target, ar e subject to risks and uncertainties, which could cause actual results to differ from the forward - looking statements. Important factors that may affect actual results or the achievability of the Company’s expectations include, but are not limited to: ( i ) expectations with respect to future operating and financial performance and growth, including if or when Clever Leaves will b eco me profitable; (ii) Clever Leaves’ ability to execute its business plans and strategy and to receive regulatory approvals; (iii) Clever Leaves’ ability to capitalize on expected marke t o pportunities, including the timing and extent to which cannabis is legalized in various jurisdictions; (iv) global economic and business conditions; (v) geopolitical events, natural disasters, ac ts of God and pandemics, including the economic and operational disruptions and other effects of COVID - 19 such as travel restrictions, disruptions to physical shipments such as outright bans o n imported products, delays in issuing licenses and permits, delays in hiring necessary personnel to carry out sales, cultivation and other tasks, and financial pressures upon Clever Leaves and it s customers; (vi) regulatory developments in key markets for the company's products, including international regulatory agency coordination and increased quality standards imposed by certain he alth regulatory agencies, and failure to otherwise comply with laws and regulations; (vii) uncertainty with respect to the requirements applicable to certain cannabis products as well th e permissibility of sample shipments, and other risks and uncertainties; (viii) consumer, legislative, and regulatory sentiment or perception regarding Clever Leaves’ products; (ix) l ack of regulatory approval and market acceptance of Clever Leaves’ new products; (x) the extent to which Clever Leaves’ is able to monetize its existing THC market quota within Colombia; (xi) dem and for Clever Leaves’ products and Clever Leaves’ ability to meet demand for its products and negotiate agreements with existing and new customers; (xii) developing product enhancements and formulations with commercial value and appeal; (xiii) product liability claims exposure; (xiv) lack of a history and experience operating a business on a large scale and across mu lti ple jurisdictions; (xv) limited experience operating as a public company; (xvi) changes in currency exchange rates and interest rates; (xvii) weather and agricultural conditions and their im pac t on the Company’s cultivation and construction plans, (xviii) Clever Leaves’ ability to hire and retain skilled personnel in the jurisdictions where it operates; (xix) Clever Leaves’ rapi d g rowth, including growth in personnel; (xx) Clever Leaves’ ability to remediate a material weakness in its internal control cover financial reporting and to develop and maintain effective interna l a nd disclosure controls; (xxi) potential litigations; (xxiii) access to additional financing; and (xxiv) completion of our construction initiatives on time and on budget. The foregoing list of fact ors is not exclusive. Additional information concerning certain of these and other risk factors is contained in Clever Leaves’ most recent filings with the SEC. All subsequent written and oral fo rward - looking statements concerning Clever Leaves and attributable to Clever Leaves or any person acting on its behalf are expressly qualified in their entirety by the cautionary sta tements above. Readers are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made. Clever Leaves expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward - looking statements contained herein to reflect any change in its expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based. Trademarks This presentation contains trademarks, service marks, trade names and copyrights of Clever Leaves and other companies, which are the property of their respective owners. 26

Disclaimer, Cont. Certain Unaudited Financial Projections This Presentation contains certain unaudited projected financial information of Clever Leaves, including a base forecast for 202 1, our financial forecast at maturity and our long - term target, as well as a forecast assuming incremental THC extract sales. These projections have not been prepared in accordance with GAAP and IFRS. Clever Leaves’ independent registered public accounting firm, has not audited, reviewed, compiled or performed any procedures with respect to the projections and does not ex press an opinion on or any form of assurance related to the projections. The projections were based on numerous variables and assumptions that are inherently uncertain and many of w hic h are beyond the control of Clever Leaves. Additionally, the projections are inherently forward looking and span multiple years. Consequently, the projections, as with all forward - looki ng information, become subject to greater unpredictability and uncertainty with each successive year. The assumptions upon which the projections were based necessarily involve judgments wi th respect to, among other things, future economic, competitive and regulatory conditions and financial market conditions, all of which are difficult or impossible to predict or es timate and most of which are beyond Clever Leaves’ control. The projections also reflect assumptions regarding the continuing nature of certain business decisions that, in reality, would be su bject to change. See “Forward - Looking Statements” above. In addition, the achievability of the forecast assuming incremental THC sales assumes the expansion of cultivation facilities in Po rtugal, utilization of all of the existing 16 hectares in Colombia, a significant increase in sales, receipt of licenses, quotas or other regulatory approvals to sell the projected volumes as wel l the opening up of the global markets for export of cannabis from Colombia into key end markets, which would create the opportunity to sell additional high THC extract. However, the timing a nd the extent to which this opportunity materializes is outside of Clever Leaves’ the Company’s control. If the full quota is not utilized, Clever Leaves will not achieve any or all increment al THC sales. Accordingly, there can be no assurance that the projections will be realized and actual results may vary materially from thos e p rojected. The inclusion of summaries of the projections in this document should not be regarded as an indication that Clever Leaves or any of its affiliates, officers, directors, advisors o r o ther representatives considered or consider the projections to be necessarily predictive of actual future events or results of Clever Leaves’ operations, and, consequently, the projections sh oul d not be relied on in such a manner. Neither Clever Leaves nor any of its affiliates, officers, directors, advisors or other representatives can give any assurance that actual results will no t differ from the projections, and neither Clever Leaves nor any of its affiliates undertakes any obligation to update or otherwise revise or reconcile the projections to reflect circumstances exis tin g or developments and events occurring after the date of the projections or that may occur in the future, even in the event that any or all of the assumptions underlying the projections are not realized. Clever Leaves does not intend to make available publicly any update or other revision to the projections, except as otherwise required by law. None of Clever Leaves nor any of its affiliates, officers, directors, advisors or other representatives has made or makes any representation to any Clever Leaves shareholder or other person regarding the ultimate performance of C lev er Leaves compared to the information contained in the projections or that the projections will be achieved. In light of the foregoing factors and the uncertainties inherent in th e p rojections, Clever Leaves’ and SAMA shareholders are cautioned not to place undue, if any, reliance on the information presented in the projections. Non - GAAP Financial Measures This presentation also contains certain non - GAAP financial measures which have not been and will not be audited. These non - GAAP financial measures are not recognized measures of financial performance or liquidity under US GAAP, but are measures used by management to monitor the underlying performance o f C lever Leaves’ business and operations. These non - GAAP measures may not be indicative of Clever Leaves’ historical operating results nor are such measures meant to be predicative o f f uture results. These measures and ratios may not be comparable to those used by other companies under the same or similar names. As such, undue reliance should not be placed on the se non - GAAP financial measures. Certain numbers herein are unaudited and are based on internal records and/or estimates. We have not reconciled the non - GAAP forward - looking in formation to their corresponding GAAP measures because the exact amounts for these items are not currently determinable without unreasonable efforts but may be significant. . 27

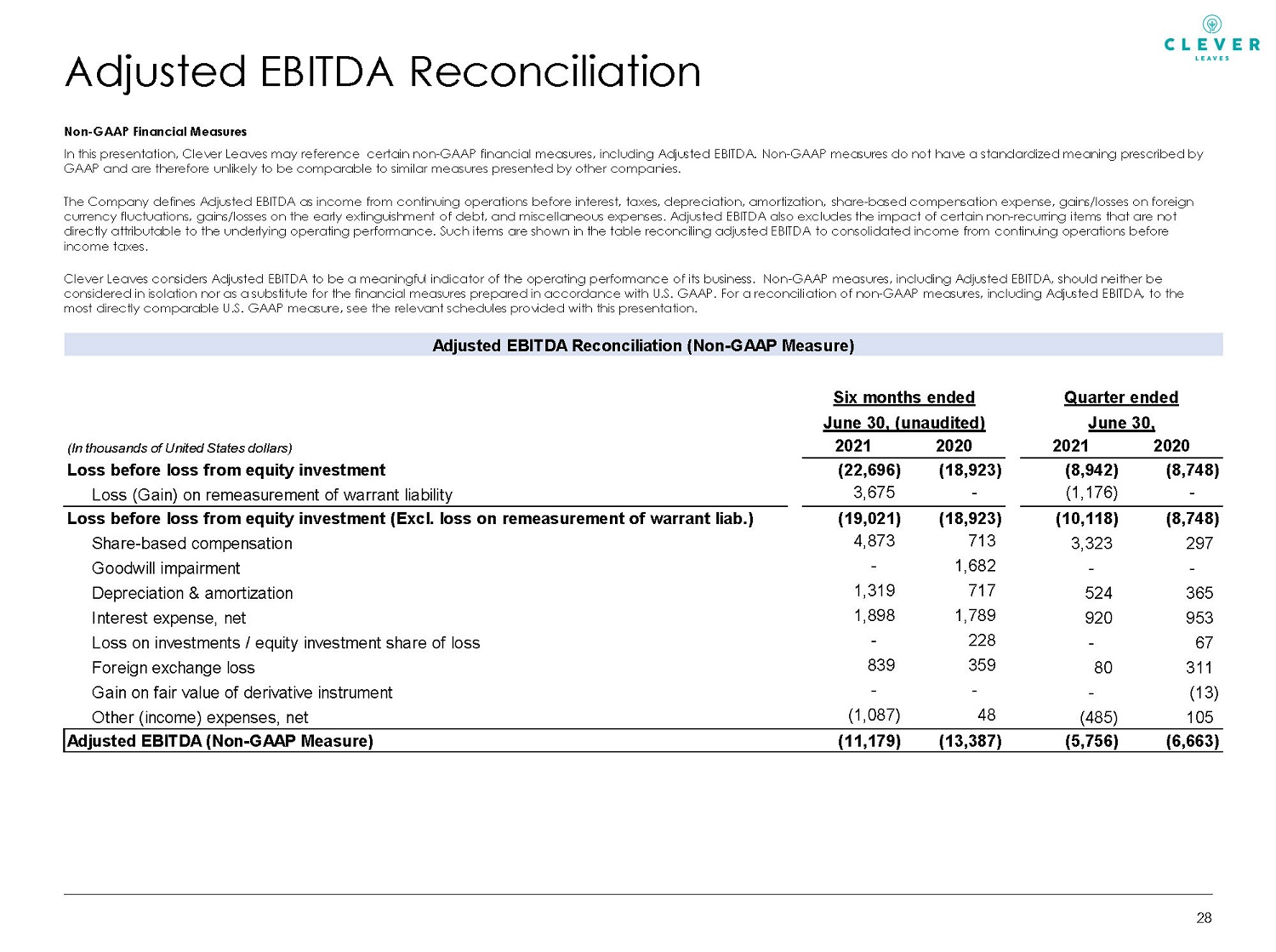

Adjusted EBITDA Reconciliation Non - GAAP Financial Measures In this presentation, Clever Leaves may reference certain non - GAAP financial measures, including Adjusted EBITDA. Non - GAAP meas ures do not have a standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies. The Company defines Adjusted EBITDA as income from continuing operations before interest, taxes, depreciation, amortization, sha re - based compensation expense, gains/losses on foreign currency fluctuations, gains/losses on the early extinguishment of debt, and miscellaneous expenses. Adjusted EBITDA also exc lud es the impact of certain non - recurring items that are not directly attributable to the underlying operating performance. Such items are shown in the table reconciling adjusted EBITDA to consolidated income from continuing operations before income taxes. Clever Leaves considers Adjusted EBITDA to be a meaningful indicator of the operating performance of its business. Non - GAAP mea sures, including Adjusted EBITDA, should neither be considered in isolation nor as a substitute for the financial measures prepared in accordance with U.S. GAAP. For a reconcili ati on of non - GAAP measures, including Adjusted EBITDA, to the most directly comparable U.S. GAAP measure, see the relevant schedules provided with this presentation. . 28 Adjusted EBITDA Reconciliation (Non-GAAP Measure) (In thousands of United States dollars) 2021 2020 2021 2020 Loss before loss from equity investment (22,696) (18,923) (8,942) (8,748) Loss (Gain) on remeasurement of warrant liability 3,675 - (1,176) - Loss before loss from equity investment (Excl. loss on remeasurement of warrant liab.) (19,021) (18,923) (10,118) (8,748) Share-based compensation 4,873 713 3,323 297 Goodwill impairment - 1,682 - - Depreciation & amortization 1,319 717 524 365 Interest expense, net 1,898 1,789 920 953 Loss on investments / equity investment share of loss - 228 - 67 Foreign exchange loss 839 359 80 311 Gain on fair value of derivative instrument - - - (13) Other (income) expenses, net (1,087) 48 (485) 105 Adjusted EBITDA (Non-GAAP Measure) (11,179) (13,387) (5,756) (6,663) Six months ended Quarter ended June 30, (unaudited) June 30,